10 Best Loan Apps In Nigeria 2020 for Students

Let’s face it, Life in ABU can be very exhausting not only physically and Psychologically but financially as well. The size of the school makes trekking all the time impossible hence you have to occasionally blow bike, most assignments are typed and in most cases spiral bind, long lecture hours mean you have to eat out some times, etc. All these can put so much pressure on our pockets and lead us to breaking point.

Take it or leave it, we all experience this at one time. Whether it’s something we planned for or not, unexpected/emergency usually sufficed and we need to bridge the cash flow gaps, you are not alone, loans can come in handy to help you in this kind of situation

That is where this list of the Best Loan Apps In Nigeria 2020 comes in. Thanks to technology, you can now get a quick loan in minutes in times of emergency to sort out your assignments, foodstuff, transport fare, etc. These apps can give you a quick and instant loan without collateral.

ALSO READ: 7 Best Free Language Learning Apps for Language Students

We have compiled a list of the best loan Apps in Nigeria 2020 that can give you a quick and instant loan and selected the top 10 best loan apps Nigeria (based on user experience) that can give you a quick and instant loan without adding to your ABU stress.

Benefits Of A Quick Loan?

Here are some quick benefits of a quick loan without collateral in Nigeria

- Get approved within few hours (Most approve your loans in minutes in Nigeria)

- No Paper Work or fillings

- Get approved without visiting any physical location

- Easy to navigate repayment schedule

How Do I Get A Loan Without Collateral?

To get a loan without collateral make sure you are not owning other mobile loan platforms, other than that, you can get your loan from these 10 top loan apps in minutes.

- Carbon (Paylater ) app.

- KiaKia App.

- FairMoney App.

- QuickCheck App.

- PalmCredit App.

- Aella App.

- Branch App.

- Sokoloan App

- Migo (kwickcash)

1. Carbon (Paylater) Loan App

Carbon, formally and popularly known as Paylater loans is top on our list of best loan Apps in Nigeria 2020. It offers quick and immediate loans of up to #1,000,000. They are powered by One Finance & Investment (RC 1044655), a registered company that is duly licensed and regulated by the CBN

Carbon has grown from a lending only institution to loan and an investment institution, which means you, can not only borrow money, you can also invest your money with an interest rate of up to 15.5% per annum. Note, the rate varies on the investment tenor you chose.

How To Apply For A Loan with Carbon

Go to Google play store and download the app, you will be required to fill in your personal details and any other necessary information. This helps to determine how much you can access as at the moment of applying, you should endeavor to fill in your info as accurate as possible (make sure you are applying with your personal mobile phone).

You will be able to see the amount that you can borrow, then you apply and be informed within a minute if the loan application is successful or not.

Required Documents To Apply For A Carbon Loan.

Like any instant online loan, you do not need any sort of documentation or collateral to apply and get approved, except an android phone to download and use the app, an internet connection and a means of identification, with these, you are set to go.

How To Make Repayment

There are several ways to repay your loan when due, Carbon (Paylater) offers you four(4) ways you can do this, without any glitch, here they are;

Carbon (Paylater) Wallet: Carbon enables you to pay your loans voluntarily right from your wallet.

ATM/Debit Card: You can enable them to remove the due loan from your bank account, via your atm card, just like using your atm card on a pos machine; you can attach your debit card for them to charge it when your loan is due.

Quickteller: Login to the Carbon app and choose to make a repayment, they are different options to choose with Quickteller listed among, select, “pay with Quickteller” follow the instructions (you will have to enter your card details) and you are good to go.

Bank Transfer: If you are left with no other option, you can repay your loans by making a transfer to the loan institution bank account. Allow up to 2–3 business days for your account to be updated on the app, if you are paying via a direct transfer and also include your full name and client ID, on your transaction ID.

2. KiaKia Loan App

Kiakia is a word in the Yoruba language, which means fast, quick and immediate. It’s an AI-powered finance platform for credit scoring and bringing lenders and borrowers together in real-time. This means you can also lend out your money on the Kiakia platform. It is one of the best loan Apps in Nigeria 2020

Kiakia, Is web-based and doesn’t have an app at the moment, you can apply for a loan via their website, with a chatbot in place to guide you from the registration process to where you get approved for the one.

ALSO READ: Top 10 Most Beautiful Universities in Africa

It’s one of the quick loans you can apply for and gets approved in minutes. They work in partnership with Sterling Bank, which means, if you are a current account in Sterling bank, it makes the process more seamless.

With Kiakia loans, you can borrow from N10,000 to N200,000. Their interest ranges from 5.6% — 24% depending on your credit score and the duration of the loan. Payback times are between 7–30 days.

How To Register For KiaKia Personal Loan In Nigeria

Go to their website, and click the, “Click to get a loan” button, you will be prompted to enter your full, email address and the phone number to be attached to your account.

This should take you nothing less than 5 minutes to fill, make sure you have access to your email and phone number as at the time you are applying.

Required Documents To Apply For Kiakia Loan

After completing your registration you will be required to upload your recent passport photograph and a work ID, If you are an employee or employer this works best for you.

Though you need a working bank account and email, I assumed you do have this before even trying to apply. You should be approved in a few hours.

How To Payback Your kiakia Loans.

When it’s time to pay back your loans, you can connect your bank account to your profile and authorize Kiakia to get the money from your bank, it is as simple as that.

If you are wondering if this is safe, absolutely you have nothing to worry about, as they utilize one of the high-end security measures in place to ensure the safety of funds.

3. FairMoney Loan App

FairMoney is one of the best loan Apps in Nigeria 2020 and surely one of the best places to get a quick loan without any issue if you are looking to get quick online loans in Nigeria. They offer a loan from N1,500 to N150,000 which is payable in one to three months.

One thing about Fair Money is, they are able to determine if you can get a loan instantly by running some analysis on your loan systematically. The faster you pay back your loans in good standing, the more funds you can access. Their interest ranges from 10% to -30% monthly.

How To Apply For Fair Money Quick Online In Nigeria

To get started, download the app on Google Playstore and fill in your details, You will be required to signup using a combination of your phone number and Facebook account with one or two questions. Make sure to answer the questions, as accurately as possible, then you can be able to apply for a loan.

How To Repay Your Loans

You can easily by opening up your app and clicking the repayment option though you can also by a direct transfer or bank deposit. To do this, you will have to include the given code on your app as the “description” of your transfer or deposit. You may be patient for like an hour, to update your details. In March 2019, they successfully disbursed N500 Million worth of loans to those applying for their loan.

4. QuickCheck Loan App

QuickCheck is also one of the best loan Apps in Nigeria 2020. It offers online soft loan in a unique way, with the use of machine learning, they are able to predict if you deserve to get a loan in minutes. Nothing like waiting for an hour or so, you are shown the results after answering the questions you will be asked.

Quickcheck is a Nigerian Startup, with an office in Lagos, their unique selling point is bringing banking services to the underserved. They offer loans up to N30,000 with an interest rate of 1% daily.

How To Apply For A Quickcheck Soft Loan In Nigeria

Head over to Google Play Store on your android phone and download it. Tap on Install, and begin the process. The process is pretty straight forward, as you will be required to link your Facebook account to further know more about you if you are eligible for a loan.

Required Documents To Apply For A Loan.

You do not need any document to apply, answer the on screen questions as accurately as possible; you will be able to get your loan in minutes.

How To Repay Your Loan

Quickcheck offers you two methods to pay back your loans. The first and most common one is the use of your debit/atm card. To pay with your atm card, open your app and click on “loan payment” and click on any of the debts you’ve attached to your account while applying for your loan, follow the on-screen process and you should be able to pay your loan in minutes.

You can also pay your loan by bank transfer/cash deposit. By bank transfer, I mean, filling up a teller in the bank, using your bank app to make a transfer and the use the USSD code to make a transfer. You have to verify your payment when you are making a transfer.

To do this, open your app, click on loan payment and select the bank transfer option. You have to fill in the details or channels you make the transfer, time, date and amount.

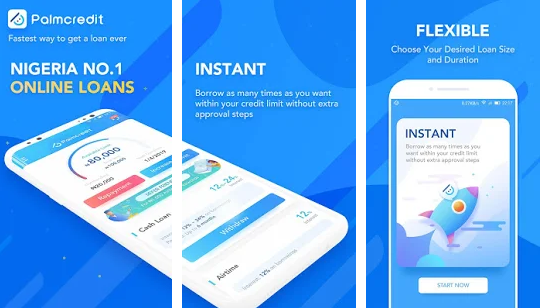

5. PalmCredit Loan App

When you think of a loan company that’s really social and listens to its customers, Palm credit fits perfectly into the description. PalmCredit Loan is an offshoot of Transsnet Financial Group, they offer loans loan up to N100,000.

They offer two types of loans for their customers;

Cash Loan: This is payable for a period of up to 3 months, with an interest rate between 12%- 24% rate of the amount borrowed.

Airtime Loan: This is payable in the space of 14 days, with an interest rate of 12%.

How To Apply For PalmCredit Urgent Loan In Nigeria

Download the PalmCredit App on Google Play store, fill in your details, you can sign up using your phone number or your Facebook account, either one you choose, you will be able to complete the registration in few minutes

You don’t need any documents to be eligible for a loan, you will be able to get your loan also without any form of collateral.

How To Pay Your Loans

PalmCredit offers you two ways to pay your loans, the first method id via their app. Open the app and navigate to the menu, click on “my loan”, click on “Outstanding, click pay now and enter your PalmCredit pin. And the second is via bank transfer.

6. AellaCredit Loan App

Aella Credit is another stellar credit company to borrow money, they’ve been in the game for a long while, and are pretty waxing strong. They offer loans from N1,500 up to N90,000 with zero late fees, unlike other loan companies. They have a monthly interest rate in the range of 4% — 29% with a loan tenor of 30–60 days.

They are able to deduce either by giving out a loan or not by checking the applicant’s info against what’s available on the three credit bureau organization in Nigeria. So, if you have no pending loans anywhere, and given the ability to pay back you shouldn’t have any issue getting your loan. Their propriety algorithm is what grades the applicants on a grade of 0–100.

How To Apply For Aella Quick Loan In Nigeria

Download the Aella Credit Loan app from Google Play store, And fill in your details, you will take a selfie and set your pin, with this you are good to go. If you pay up your loan offer on time without being late, you will be granted access to a higher loan when next you are applying for a loan.

While registering, you will be required to attach your debit card details; this is required for the loan to be disbursed. When it’s time to pay your loan, the amount due will be deducted from your card. Or if you want to pay via bank transfer, they offer this option. Either one you.

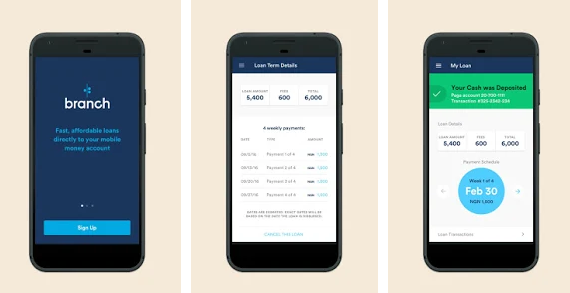

7. Branch Loan App

Branch offers quick loans in Nigeria without collateral or any hassle, you can get up to N150, 000 with time as you build your creditworthiness. The branch is not only operational in Nigeria, but they also operate from the other four countries, which are Kenya, Tanzania, India, and Mexico. Their interest rate ranges from 1% — 21%, this is typically influenced by your banking history, how long you’ll be repaying, amount of the loan. It is number one for many on the list of best loan Apps In Nigeria 2020

Types Of Branch Loan

The branch app offers up to five types of loans, listed below.

Personal Loans in Nigeria: Getting a personal loan is one of the ways to stay in control of your finances while walking through life’s opportunities and expectations.

Travel Loans in Nigeria: is a special loan gotten for travel purposes. It’s a form of unsecured personal loan. It covers all expenses incurred during travel, this can be accommodation, transport airfares, and other ancillary costs

Business Loans in Nigeria: Cash flow is the bloodline of every business, at any point in time, there may be a need to inject some funds into the business to keep going and running smoothly. Branch offers you the opportunity to apply for a business loan via its app.

Medical Loans in Nigeria: This is still under personal loans except, it’s now specific, what we intend to do with the loan. Medical loans are taken to finance medical procedures, surgical operations, medical debt reconciliations, and other related costs.

Emergency Loans in Nigeria: If you need money in an emergency situation, you can apply to the branch to get one.

How To Apply For Branch Instant Loan In Nigeria

Go ahead to download and install the Branch App on Google Play store, fill in your personal and bank details to receive your loans. You should see a loan offer on the dashboard, you need to first use this, so you can see higher loan offers.

After installing the app, you may be wondering, How long does it take to process a branch loan? To process your loan, it should take less than 3 minutes.

How To Pay For Branch Loan In Nigeria

Branch offers you 4 method to pay up your loan, the first is the use of your debit/atm card. You will need to input the card details, attach it and you will be able to pay with your card.

You can pay with your bank account, though this option is not your open to all bank, your bank may be one of the selected. You can also pay with a direct transfer and USSD code. USSD Code is only available for GT bank at the moment.

8. Migo (KwikMoney)

Migo (Kwikmoney) is a web-based automated loan service that offers “Kwik” (slang for quick) easy-to-access to individuals and business owners without collateral or documentation. It is one of the best loan Apps In Nigeria 2020 and My Personal favorite.

Whether you are in need of capital to support your business or need some cash to take care of some emergency needs, KwikMoney lets you access instant loans of between ₦500 to ₦500,000.

KwikMoney usually starts with a small amount and the subsequent loan amount is increased as you build trust with the system by prepaying your loan on time.

KwikMoney loan tenors are usually 14-30 days, with interest rates of up to 30%.

As you take loans and payback early, the system trusts you more, hence, offering you higher amounts for subsequent loans.

How Migo (Kwikmoney) Works

Visit https://my.migo.com and register with your phone number to see your loan offer.

Or dial *561# and navigate to “Request Loan”.

9. Sokoloan

Sokoloan is an online lending platform that provides short-term loans to help take care of unexpected financial needs or expenses.

Sokoloan is simple, straightforward and funds are typically received within 5 minutes to your bank account.

Also, no collateral, paperwork or documents is needed whatsoever to get a loan. All that is needed is a means of identification and valid bank details to be able to successfully procure a loan. It is one of the best loan Apps In Nigeria 2020

How Sokoloan Works

1. Download the Sokoloan app

The Sokoloan app is only available on Android smartphone devices. You can download the app on Google play store using the link below.

2. Introduce yourself

Here you fill out the brief application form with your personal information and apply for a loan.

3. Money in your account

Once your loan is approved, funds are typically received within 5 minutes to your bank account.

4. Repay loan

Timely repayment of your loans will grant you access to higher credit limits for subsequent loans.

In Summary: The Best Loan Apps In Nigeria 2020 To Get Instant Loans.

From the list of the best loan Apps In Nigeria 2020 mentioned above, you may be wondering which specific one to go with. Well, I have tested all, they are all efficient and I can confidently recommend any of them.

In Conclusion

When applying for a loan with any of the best loan Apps In Nigeria 2020 listed above, you should take the due diligence of checking through the interest rate, the loan tenor and lastly there is nothing like free loans in Nigeria or any elsewhere, make sure you are only applying to the fast cash loans, if you really need it. ⚠️ WARNING⚠️: THIS IS A LOAN AND NOT FREE MONEY. BORROW ONLY THAT WHICH YOU CAN AFFORD TO PAY AND ONLY WHEN IT IS VERY VERY URGENT.