5 tips to avoid living beyond your means on Campus

Living beyond your means is the precarious situation that many ABU students have found themselves in. Living from month-to-month is a typical situation for the majority of Abusites. Without a regular income, they usually rely on their parents for financial support and some supplement by taking up part-time jobs. ABU students have many opportunities and temptations to overspend.

The latest gadgets, hobbies, dining, and social activities can leave one with a huge hole in the wallet. Or worse still, with a deficit that is paid off personal loans. Borrowing does not help solve the problem and can only make matters worse. Here are five tips to avoid living beyond your means and help ABU Students manage their money better.

1. Take charge of your expenses

Do you know exactly where your money goes, or do you just fork out money as and when? Many ABU students don’t have a good idea of how much they spend each month. When they realise that they are running out of money, it’s already too late.

The first step to good money management is to start tracking your expenses. No matter how small, each expense adds up. Keeps tabs on spending by recording expenses and categorising them. Keep doing so for one month and you will have a good grasp of your consumption pattern, how much you have spent and where did you spend on.

If you have a tendency to overspend, try cutting back by 5-10% on each expense category. Cutting down on your unnecessary items will help you be better off financially.

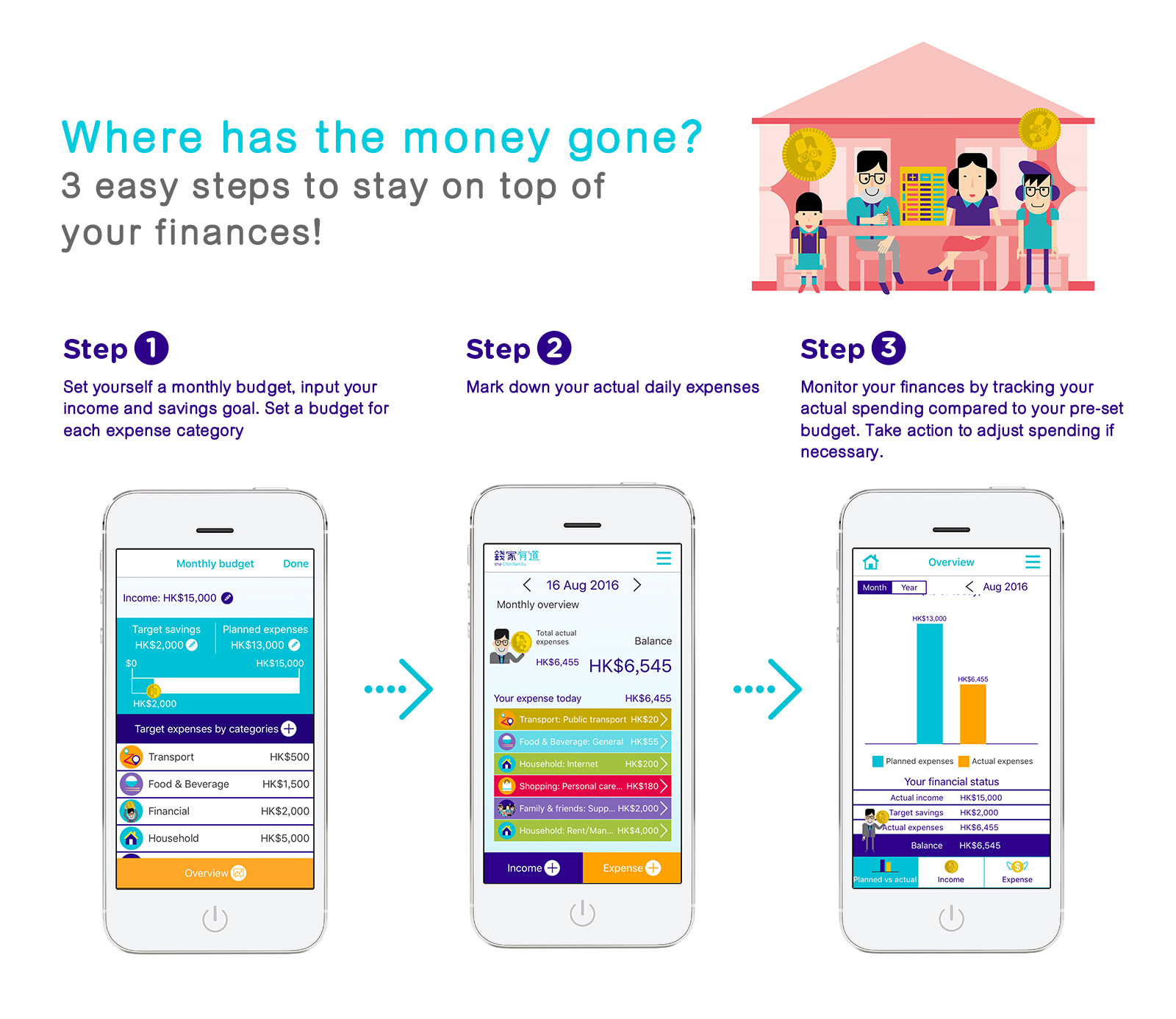

Many might consider expense tracking to be quite tedious, but there are online tools that can help you with it. The Money Tracker Mobile Application, a personal mobile money management tool developed by The Chin Family, can help you track your income and expenses anytime, anywhere, making it fun and easy.

2. Stick to your budget

The Money Tracker app also helps you to formulate, balance and manage your monthly budget. You can do so by listing your monthly income (allowance, salary from part-time job, etc.) and the target saving amount (say 10% of your income) in the Money Tracker, which will then generate the amount for you to spend each month.

Based on your consumption pattern and needs, you can compute what you expect to spend every month for the different categories. The key to good money management is to adhere to the plan by saving and spending as planned. Complement this with daily money tracking, weekly progress reviews and compare your budget against actual expenditures.

Sticking to a budget doesn’t have to be a painful exercise. Giving yourself a treat from time to time isn’t such a bad idea, but it would mean being more frugal on something else.

3. Develop responsible spending habits

Your time at Ahmadu Bello University can be one of the best experiences in life. But there is also a tendency to overspend as you start to become more financially independent. Take a good look at what you “need” versus what you “want”, and differentiate between the two.

Be selective and smart about how you spend your money. For example, there may be many campus activities but you can always choose to take part in those that are relevant and within your affordability. You do not have to participate in every social event. When gifting, give something thoughtful and handmade instead of buying an expensive present. Also, think twice before you go for that latest electronic gadget.

Impulse buying can undermine our budgeting and savings plan, especially during the sales season. We often equate seasonal sales and discounts with getting great deals, and this in turn encourages us to spend more. If you come across something that you would like to buy, try taking a step back and delay your purchase decision. Decide if it’s a necessity. If you can’t find a good answer, put the item back.

4. Make good use of student offers

Sale events are frequently organised on campus, and you can also check out the list of outlets that offer student discounts on food, beverages, apparels, glasses, mobile phones, computers, watches, etc. There are also student prices for movie tickets, museums, art performances, etc. Bring along your student card when you shop and no harm asking if they have student offers. Of course, be sure about what you need before you spend.

5. Increase your income

Identifying new sources of income and cutting back on expenses is a fool-proof way to improve your finances. Provided that it does not affect your studies, consider taking up a side hustle such as private tutoring to increase your income. Summer and semester breaks offer great opportunities to earn extra money. Internships or job opportunities are available in public bodies and private companies.

On top of monetary gains, the work experience will also prove invaluable when you step into the job market. Visit your career development centre on campus, check recruitment sites or company websites to do your research. Stay vigilant when you are looking for part-time or summer jobs and be careful not to fall for employment fraud.

Money management is not all that difficult. Everyone is able to improve their financial circumstances. Discipline and willpower are the keys to success!

Credit: www.thechinfamily.hk

For Advert Placement, Sponsorship, support, Article submission, suggestion, etc, Contact us: info@theabusites.com, +2349015751816 (WhatsApp)