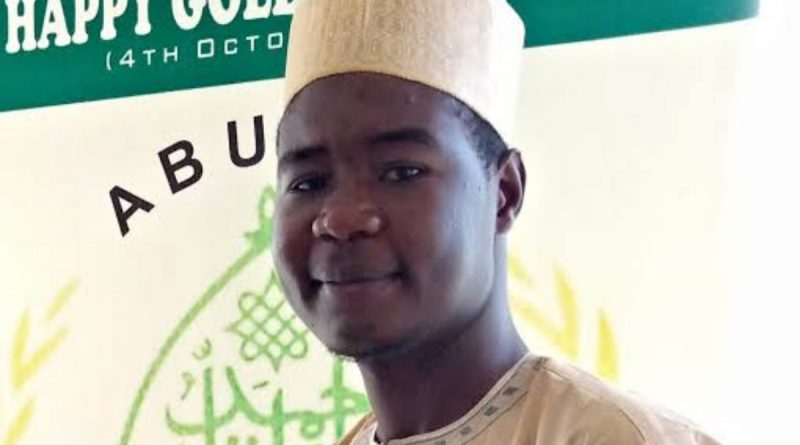

Aminu Bakori: The young Abusite whiz programmer (Founder of Payant.NG)

Most of us are familiar with the common pattern these days: tens of thousands of graduates are churned out of our universities every year with no guarantee that majority of them will be getting jobs soon after graduation (except for the few fortunate ones who have some “connections”, maybe).

The regular employment market is obviously over-saturated and the situation looks pretty dire for the ordinary graduate who has no connections.

However, it seems some few ones among them know how to find their way out even without the usual connections as we know it.

In this special interview, Auwal Adamu Gene (Head of Web Management Unit at ICICT, ABU Zaria) assisted by Abubakar Shuaibu had an exclusive interview with one of ABU’s ordinary graduates who – with nothing other than vision, guts, and grit – went out of the norm and dared to chart his own destiny by floating a Fin-Tech Company a little over a year after graduation.

And just two years after launching, the start-up has gone ahead to help process over six billion naira in transactions for various individuals and companies across Africa and still growing. We invite you to meet Aminu Bakori, a BSc Statistics “ordinary graduate” of ABU (Class of 2015) who is the brain behind the Fin-Tech Company, Payant.NG.

Please tell us about yourself: who is Aminu Bakori?

My name is Aminu Bakori and I’m from Katsina State. I was born in Katsina but I have lived almost all my life in Kaduna – specifically [grew up] in Zaria where I studied from Nursery school to my University days. I basically lived all my life here in Kaduna [State]. I joined ABU Zaria in 2011 where I studied Statistics and graduated in 2015.

After graduation… what did you do as per getting a job?

To answer that question, I will link it to my University days because while I was in the University I wasn’t that student who always think of going out of the University system and then focusing on getting a job and you know… what have you.

Of course advancing my studies was also one of the things I was looking at but the entrepreneurship skills I had even while I was still in school pushed me towards building companies even before graduating. So [after] graduating the basic thing that came to my mind was what should I do at this point in time?

I had two options: it was either I take a brown envelope with my credentials inside and start scouting for a job up and down or I start something which could benefit me and also benefit other graduates coming from the University system.

So, graduating from ABU I started something called Payant. Payant is a company that provides payment services to individuals and companies across Africa.

We started Payant in 2017 – the first of January 2017 to be more specific – and over the past two years we’ve gone from just processing online payments to also offline payments now for several merchants across the country and across the continent in Africa.

What inspired you to go into Fin-Tech business out of all the other possible [easier] options?

When I was in the University one thing I did was something called freelancing. The idea of freelancing is you building applications for clients, merchants, businesses… and one major problem I had that time was processing payments for my merchants.

So I’ve had the opportunity of working for several companies not only in Nigeria but also across the world. And one major problem I’ve always had at that time was processing payments from outside the country down to Nigeria.

Because whenever you make any project you get paid for that project, right? So, processing that payment was one of the major challenges I had.

Then secondly there’s this software I built called an enterprise management system (EMS) through my company called Friendstie (so it was called Friendstie EMS). What that software does is it allows big companies, big merchants to manage everything regarding their operations.

So it goes from inventory to staff management to payroll to invoices to payments ‐ everything regarding their business. So it was a complete enterprise scheme that allows businesses to manage their day-to-day activities.

So looking at that software after graduating, one of the major things that was used on that software was the payments and invoicing aspect of it. So I tend to look at it like “how can we extend this service to other businesses?”.

You know if these businesses were using these [two] modules of the software then it actually means that other businesses are also in need of this service. So that was how the idea of Payant came up.

How was it like facing the formidable Fin-Tech giants like Interswitch, Remita and VoguePay for example?

Initially when we started Payant we had to look at the fintech spectrum from the beginning to the end. From doing card payments online to how these card payments are being processed to connections with the banks to other key players in the system.

And one thing we discovered with the existing payment schemes was that they tend to provide APIs – application programming interfaces – and these things are provided for developers to build on.

So it means a school that wants to accept payments will need a developer to start building products on top of those APIs. So from day one we wanted to scrap all that out;

we wanted to provide payment services that allow people to just go on to a website, register themselves, start accepting payments without the need of them needing any developer or needing any mobile app.

So what we did from the initial point in time we started was called ourselves an easy online payment platform for freelancers. That was the initial pitch for Payant. So, we created this platform that allows someone to register and create an invoice, send it to a client and that client makes the payment using online platform.

So it’s no longer you accessing payment services by you, say, building on top of those payment platforms because the reality of individuals and businesses in Africa is in over 70% of cases, these businesses are not tech-savvy.

Their businesses are not even tech-focused completely. All they just wish to do is accept payment online. They care about getting paid, not about how the systems work between the banks and so on. What they just need is let me accept my payment, let it hit my account and let’s move on.

Rumours have it that Payant successfully process hundreds of millions of naira worth of transactions locally and internationally since inception. Are those rumours true?

Yes, it’s true even though we’ve gone beyond just processing hundreds of millions of naira in transaction value. In the first year of operations at Payant, we processed over a hundred million naira in transaction volume with over a thousand merchants.

And in the second year from January to June that year (that’s 2018) we’ve gone ten times that volume which is one billion naira in transaction volume. By the close of 2018, we’ve processed over six billion naira in transaction volume.

How do you tackle the issue of security and trust in your transactions, given that financial transactions are particularly sensitive and given that Nigeria is rather notorious for internet / electronic fraud?

There are lots of regulations as regards how Fin-Tech companies operate in Nigeria and also internationally. One thing is for every business or individual that needs to utilize your service, there must be the minimum KYC which is “Know Your Customer” in our database.

So we need to know who he is, where he is, what kind of business he is doing… so that at any point in time we know which kind of transactions this customer is going to process.

Then the second thing I would say is in Nigeria we are blessed to have a more elaborate, more secure Fin-Tech space because the banks have tried as much as they could to make sure that transactions are being processed using certain security levels before those transactions are [allowed to be] processed by any scheme.

Locally, we use a PIN which is the one we basically use on our ATM, right? So, whenever you come on to our payment scheme you either go through the PIN method or you use something we call the 3D secure method which is more specific to Visa cards and international cards.

So the way our authentication process works is this: a customer comes to our system he provides his card information and we pass it to the bank. The bank decides which authentication method to use for that transaction.

So when it is an OTP transaction which is like a six-digit number that’s sent to the customer’s mobile phone, it’s the bank handling that, we have no control over that aspect.

By the time the customer provides the OTP we pass it to the bank and they decide whether it’s right or true or valid. The same thing applies to higher-end merchants or higher-end individuals who have their hardware tokens.

Then another payment scheme we use aside from the card is also account number payment, which also follows the same procedure where the customer comes on to the system, he provides his account number and then an OTP is sent by his bank.

When the bank issues that OTP to the customer we pass it and process the transaction the same way we do for the card. The same thing applies with USSD payments. And then last one which is cash payment… for cash you know the customer is simply walking into a bank to make cash payment.

Today we can process payments from any bank branch across the country. A certain example I’ll give you on this is school payments. You want to pay fees for your child who is, say, in a secondary school.

The common way which these schools do it is they tend to issue tellers by the end of the Term and this teller let’s say is issued by Bank X where the school’s account is domiciled. So, that parent will definitely need to go into Bank X to make that payment.

But what we did was, we’ve already integrated with all banks in such a way that you can walk into any other bank’s branch and make that payment. The parent need not go specifically to that Bank X to make that payment… they can go to Bank Y, Z, A, B, C… whatever and make that payment at any bank branch and the money will hit the school’s account appropriately.

How easy or difficult will it be, especially as regards getting the regulatory license to operate a Fin-Tech company like yours?

Fin-Tech is one of those restricted areas where you don’t just go into, right? Even at Payant today we’re still battling with complete complying with all the regulations and what have you we have at the moment.

But one of the major things I want to say as regards starting a Fin-Tech company is regarding partnerships. So there is no way a single player in the Fin-Tech space can work in a solo form without working with other key players.

So I’m talking about other Fin-Techs in the space, a typical example I’ll give you is Interswitch. Every Fin-Tech player right now has to follow through Interswitch to process local transactions. So [Interswitch] has become that “grandfather” for all Fin-Techs in the country. That’s the first thing.

The second thing is as regards to banks. You have to talk to them and work out agreements. At the moment we are currently partnering with three banks and we keep on adding more banks as time goes on. So partnerships is one of them, and working hand-in-hand with regulators to ensure compliance is another important factor.

I would also want to add that one of the key, major challenge we had as regards regulations is how strict those regulations are. They tend to set a very, very high barrier of entry for people who want to go into the Fin-Tech space.

Every single year, what we see is… “what happens to that person who graduates from the University and wants to build a product that solves a real life problem when the regulator is setting high barriers that can only be attained by bigger corporations?”

What was the most interesting software engineering challenge you tackled in the course of building your Fin-Tech platform and how long did that take you to tackle successfully?

Yeah, of course we have to face a lot of challenges as regards to building the software to run Payant and all our several services we operate with: be it our connections with the Banks, our connections with NIBSS (the Nigeria Inter-Bank Settlement System) and what have you.

So one of the first problems we had was in connection with the banks themselves. [You remember] we were talking about security and trust some few minutes ago, right?

So one of the key things we do here is we have to communicate via private networks (VPNs) so its no longer the normal “internet” we have. Our servers are still on the cloud but they are purely on a private network where we communicate with the banks and other key players in the scheme.

So, those VPN connections are in most cases not something the banks are conversant with – most especially when you connect with cloud servers – because we’ve had cases where the bank network guys will tell you this is the first time they are connecting with a cloud server.

All the time they connect with physical servers but then, as a startup, scaling is one thing we do every single day. You can’t just have local servers [doing the job effectively] because in Nigeria we have so many challenges to having that:

first is electricity, then there’s network connectivity problems and your customers don’t understand “oh no, their server was down because electricity was down…” or “MTN was down… or some other mobile network was down.” They don’t understand any of that.

What they want is come on to your system, process that payment and move. They don’t want a situation where they come on to a scheme and [the transaction] fails or doesn’t go through. The customer tends to get frustrated with that. So we had to tackle that head on.

This brings us to the second issue of scale. When we started Payant just like any new startup we were looking out for our first customer, then the second customer and at that point in time the traffic was low, transaction volume was definitely low.

But then you get to this point where you have to process many transactions at any point in time and you need to scale more. One story I’d like to tell you to give you more in-depth information about the technical challenges we faced is one as regards to time stamping.

So before, previously, we set our transactions to have the current time stamp, which is the Unix timestamp on the Linux system. So for every transaction we just passed that because we thought one transaction in a second was pretty fine.

But then, interestingly we get to this point where we start to see failures in transactions volume. And we were like, “what exactly was happening at that point in time?”. Then looking at the system [we found] those transactions that were actually failing was because we were processing more than one transaction in a single second.

So which means we had to find a way of separating transactions that come in at that specific second in time. That was the first interesting problem we had; and that had to be solved.

The second one we had was as regards to our servers scaling. The servers you start with one two servers, right? In some cases startups start with shared hosting service where they just upload everything, then they are fine.

But then you get to this point where it doesn’t work. And I would tell you that up until I think last week, we’ve been having issues with our server CPU where our CPU usage was always at 100% utilization. We had no idea what was going on! But interestingly we were able to optimize a lot of things we do internally and at the moment we’re doing about 33% server CPU usage.

Now we’re curious, is there any other ABU graduate working with you in your company?

At the moment my Co-Founder is also an ex student of ABU, yes.

So apart from your Co-Founder, are there many more people working with you there?

At the moment we have five people working with us at Payant. My Co-Founder and I lead the whole company. I handle everything regarding technicalities of the company, how our products are being built, We have three products at the moment which are being used by several segmentations of merchants.

We have Payant which handles more specifically merchants who process online payments and also offline payments. We have a USSD scheme which is being used by these guys who are by the roadside processing payments and receiving payments for people which is called myFlex.

And this individual product which is called dot which is an individual product, a mobile app whereby you come with your USSD to receive and make payments, make transfers, pay bills — electricity bills, dstv subscriptions, and so on.

At the moment everyone handles everything from product development to marketing, design… Interestingly, one of our key major areas this year is growth so we want to see how we can get more people on board…

What are the key lessons you learnt on your interesting journey of starting a Fin Tech Company from scratch all by yourself with only a handful of people?

One of the key things I learnt since I started Payant is team building. You know getting the right persons on to the team is highly important. Otherwise when you have somebody who does absolutely nothing, somebody who contributes less to the company… it affects the whole company.

You see we are not talking about a company with hundreds or thousands of staff here. We are talking about a few number of people. It means any person who is relaxing or is ineffective will affect other people’s effectiveness and delivery of service.

So team building was one of the major things I had to focus on. From the early days (I must admit) I made a lot of mistakes on that you know… But we learned on the job and here’s where we are today.

Now, let’s come back home to ABU where we groomed you (we’re proud to claim that). Can you advise the ABU Management and Community on one or two ways they may not just encourage but actively facilitate serious entrepreneurship amongst upcoming students?

Sure, I have a couple of advice I’ll like to give both to the students and also management. As regards to management I think more efforts have to be made not just towards getting people, students, going into entrepreneurship, but also showing the value of going into entrepreneurship.

Because today – if I did not start Payant – I would have been a plus 1 to the number of graduates looking for jobs across the country, right? But then starting Payant, I am doing minus 1 a certain number of people who are currently off the employment scheme.

So you need to show students the value of entrepreneurship. So it’s no longer you just going into class and telling them “hey, you need to start a company, this is how you do a business plan…” and so on. It goes beyond that. There have to be a practical aspect of it; they need to be made to understand how products are being built in the real world.

On the students’ side, I’ll give a quick example of the SIWES programme. It is a time when most students tend to relax and “flex”, if I can use that word… they just stay at home and do next to nothing.

One of the things I did during my own SIWES time was to improve on what I did at my previous company which was Friendstie. And at that point in time I could vividly remember was when I built my first big project that I built for a certain company.

So, students need to utilize that time to learn about building real-life solutions. Most especially when you realize that you are going to 400 level immediately you come back and you’d be working on your final year projects and all of that.

You need to start looking at real life problems rather than you going into the library and… you know… picking up old projects and replicating them. I can remember that at 200 level that was when I started learning about cryptography, how it works, the mathematics behind it…

And at 400 level I was doing operations research, I was doing more advanced regression analyses, I was also looking at AI and machine learning algorithms and how they work. [Not minding that I was a Statistics Major] it really helped me in computing.

As I was saying, it was at 400 level that I started to learn about more advanced things. After graduating, I discovered interestingly that these are the basic things that are being used in computing today.

This is why, even though I was let’s say angry that I couldn’t study Computer Science at the University even despite several efforts to change from Statistics, it doesn’t change the fact that studying Statistics also helps me in my everyday activities at Payant today.

A certain example I’ll give you is as regards to how we handle transactions and how we handle our customers. Take a look at this: when we started Payant, a lot of transactions were failing at that point in time because we were trying to focus on getting more customers (and also how we could improve our transactions)

But it gets to this point where you have to improve your transactions else a lot of customers will go off your system because it’s no longer effective due to a lot of transactions failing. So how did we handle that?

The first thing we did was to see how we could build an AI system that looks at our data and see what is important in our database and what important metrics we tend to measure. As a Statistics graduate I already knew how to do data collection, what are the right variables to look at, when you do regression analysis what do you look at, how you plot your graphs and so on.

And interestingly we started looking at every activity our customers do: from changing their payment scheme – say for example he was on card payment but now changing to account payment – why did he change it to account payment?

Was the transaction failed at that point he switched from card? Which bank issued that card? What card scheme was it? And then at the end of the month we plot in the graphs and looking at it, it became vividly clear that these were where the problems are and immediately we fixed that, it was fine. The same applies to transfers and what have you.

I think about two weeks ago I was talking in Kaduna while I was there at CoLAB (that’s the innovation space at Kaduna) and I was talking about how we were able to improve on our transfers last year we closed at 98% efficiency.

We are 98% confident at Payant that when you make a transfer on our scheme, it will pass through. So in summary all these just goes to show that whatever a serious student learns in school will ultimately turn out to help him or her after graduation.

And going back to the University Management, one other major area I think they can help students is by ensuring that every student has access to the school email.

An example is I can have aminubakori@abu.edu.ng so that as a student whenever I apply for services or I apply for discounts or software; or trying to have access to Microsoft services, GitHub or what have you… it helps to give me more credibility as a student, rather than having say, a normal email address like aminubakori@yahoo.com.

Out there, the outside world other than Nigeria prioritizes students and they give discounts a lot when you buy books, you get discounts or free genuine software – I know Microsoft does that – having access to cloud services is easier for students… So it’s highly important that the University looks into that and make it a reality.

Now, what specific community services did you render to ABU while you were here with us as a student?

One of the things I did while I was in the University was something called ABU Devs – a community of students and also some few lecturers who come together to learn about advanced technologies, see how we can extend that knowledge to other students in the University.

So I was opportuned to be one of the three Microsoft Student Partners in northern Nigeria at that time where we got to learn a lot of stuff from Microsoft and their staff and some of their partners, riding on that partnership we had with them as Student Partners.

So in trying to extend that knowledge to other students we organized events like meetups within ourselves and… it goes beyond just the usual tutorials you have [to help yourselves, you know]…

It was a more organized way of imparting knowledge to the students, encouraging them to think of how they can take what they are doing today and apply it onto the real world outside school. So ABUDevs was one of it.

I was also part of Microsoft Youth Spark Advocacy, Nigeria was opportuned at that time to have only about four I think, and there were only about a hundred and something across the whole world.

So we were working hand-in-hand with Microsoft at that time to see how we could spark positive youth activity in general beyond just students. You know, it was about how we could [influence them to] change their mindsets to leave street life and go to school and learn about technologies to solve real-life problems, and so on.

Now, looking at what we’ve learnt about you today, you must be a sort of role model for many of our students right now. But how about you – any hint about who your mentor or role model is or are?

Yes, there a number of people I look up to, right? When I started about 8-10 years back learning about technology it was very hard to look up to somebody locally to see somebody who was doing stuff here in Nigeria or even in Africa because a lot of the people doing things were mostly in the Western world: the US especially.

So in most cases we were working with the likes of Microsoft, the likes of Google, Facebook and what have you. And even up until today this is mostly what still obtains. So it was rather hard to have people you could look up to locally.

But internationally I could say I was looking up to a couple of people: Steve Jobs of Apple was one of them. I was really keying into his design, his thinking and his ability to influence a lot of people.

The same thing applies to Bill Gates most especially considering how he was able to market Microsoft to the whole world. Then Mark Zuckerberg at his young age graduating from.. oh! He didn’t even graduate from the university, right? But building a world-class company and becoming one of the top KPIs in the technology world…

But locally at a later point in time there were a couple of people that I look up to. One of them is Professor Sahalu of ABU here who was the Director of Iya Abubakar ICT Centre; and Mallam Khaleel [Zakari] who was also one of my key role models. We’ve worked hand-in-hand to see how I could improve what I do.

I’m sure a number of people will like to reach out either to you as a person or to Payant as a company. How can people reach you?

Yes, the company website itself is https://payant.ng; and then for my personal contact, I think my email address will probably be sufficient: aminu@payant.ng. Messages will reach me and I’ll be happy to help anybody. Thank you.

Credit to Auwal Adamu Gene (Head of Web Management Unit at ICICT, ABU Zaria) and Abubakar Shuaibu